Homes that have a higher flood risk will pay more for homes with a low flood risk.įor example, FEMA’s Risk Rating 2.0 takes into account the elevation of your home, the foundation type, first floor height and the distance to water. Flood riskįlood insurance costs are largely based on your property’s flood risk.

FEMA FLOOD INSURANCE RATES FULL

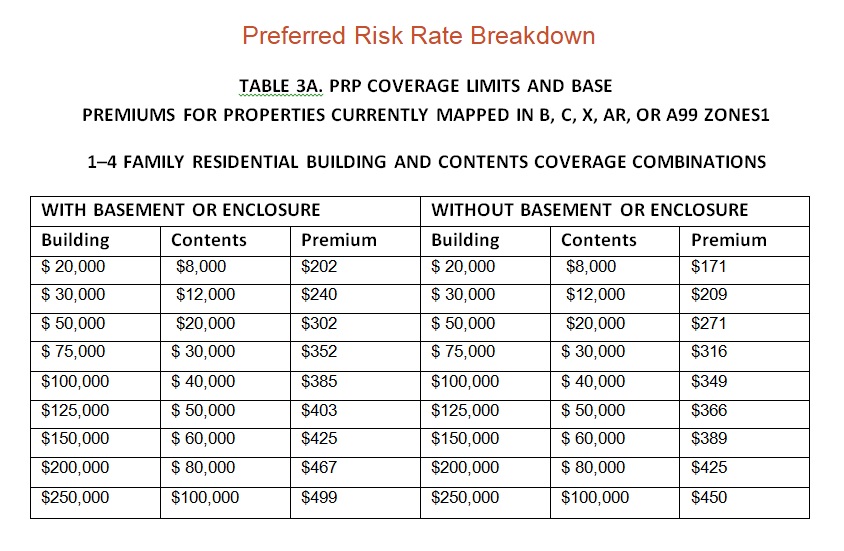

Here’s a full list of what factors influence flood insurance costs. Factors That Determine Flood Insurance CostĬommon factors that determine flood insurance costs include a property’s flood risk, building characteristics, type of policy and deductible amount. Homes in high-risk areas cost more for flood insurance. Your property’s flood risk is a major cost factor. That doesn’t mean you will always pay more if you live in those states. Here are the five most expensive states for flood insurance: The most expensive state for flood insurance is Connecticut with an average cost of $1,491 a year. Most Expensive States for Flood Insurance Here are the five cheapest states for flood insurance:

The cheapest state for flood insurance is Nevada with an average cost of $593 per year. Source: Federal Emergency Management Agency. Here are the average annual flood insurance costs by state for a policy from the National Flood Insurance Program, according to a Forbes Advisor analysis of flood insurance rates. How Much Does Flood Insurance Cost in my State?įlood insurance costs vary based on multiple factors, including where you live, the cost to replace your home and how much coverage you buy. Most homeowners with flood insurance buy it from the National Flood Insurance Program, but you may be able to purchase a policy in the private market.Ī flood insurance policy typically covers you for flooding related to torrential rains, storm surges, inland flooding, flash floods and other times when water may flood from outside your home. To get flood coverage, you need a separate flood insurance policy.

Standard homeowners insurance does not cover flood damage that’s caused from water coming from outside the home’s foundation.Ī standard homeowners policy includes insurance for water damage if it’s caused by something like a sudden burst pipe, accidental leaks, ice dams and water from a roof leak.

0 kommentar(er)

0 kommentar(er)